Gold has seen a 7% pullback recently, dropping from $2,800/oz to just below $2,600/oz.

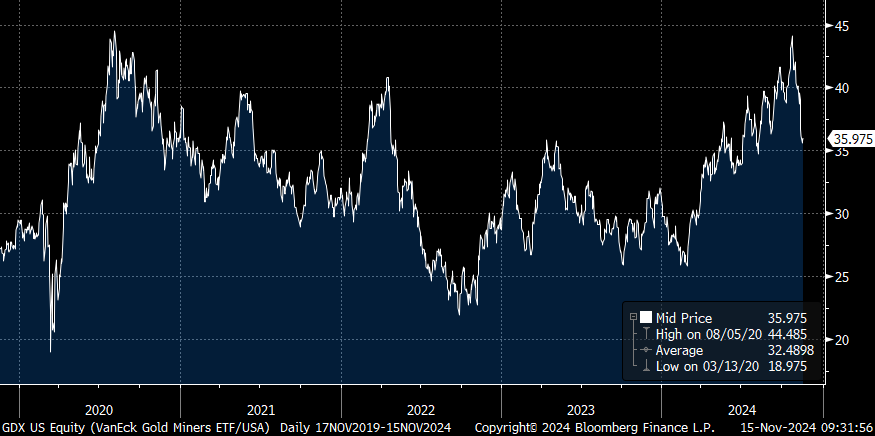

Meanwhile, the GDX Gold Miner ETF has slumped by 18%.

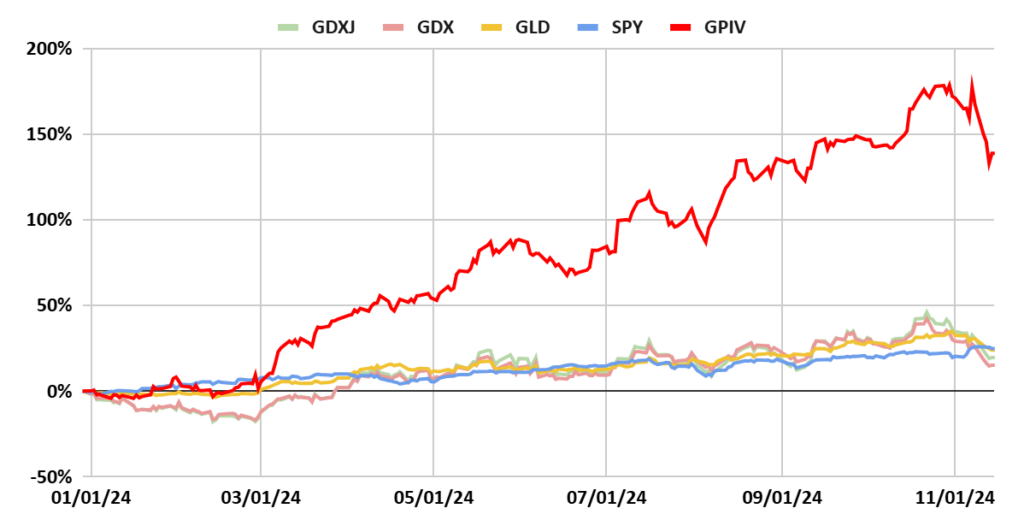

In comparison, our own Golden Portfolio IV (GPIV) has held up better, declining only 14% in the same period. This demonstrates the resilience of a well-structured gold investment strategy, even in a volatile market.

The Trump Effect: Don’t Be Fooled by the Hype

The recent excitement surrounding Trump’s victory has led many investors to believe he will somehow cut government spending and solve the debt crisis.

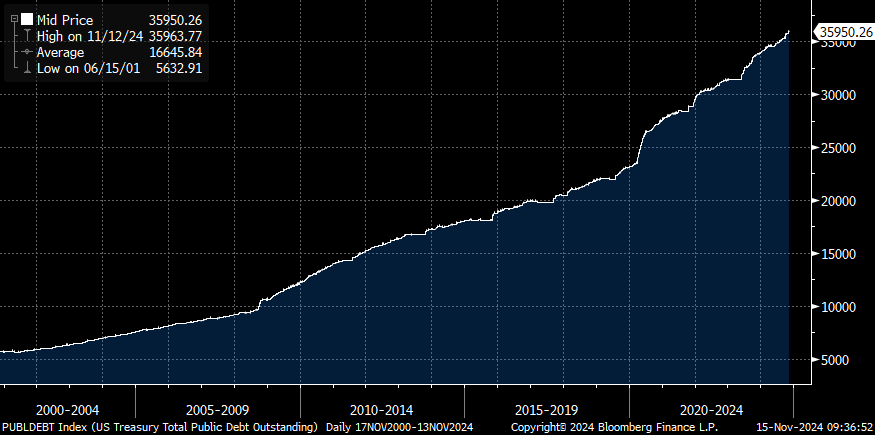

Let me be clear: This is wishful thinking. His proposed tax cuts will decrease government revenue, while new tariffs are likely to put a dent in GDP. Remember, during Trump’s last term, U.S. national debt increased by $8 trillion — the same amount Biden added during his tenure.

Trump is no stranger to debt; it’s the foundation of his real estate empire. He once proclaimed, “I’m the king of debt. I’m great with debt. Nobody knows debt better than me.” He even boasted about renegotiating debt if things didn’t go as planned. Now, as a politician, he doesn’t have to renegotiate — he’s in control of the money printer.

Fiscal Responsibility Is Dead: What This Means for Gold

Let’s face it, neither political party has any real intention of reducing the national debt. It wasn’t even a topic of debate during the recent election cycle. Instead, both parties have embraced the ideas of Modern Monetary Theory (MMT), popularized by economist Stephanie Kelton. MMT argues that debt doesn’t matter as long as the economy grows and that the government can always print more money to pay off its debts. According to MMT, there’s no link between money supply and inflation, and inflation is only a concern when the economy reaches full employment.

In simpler terms, MMT is a “Magic Money Tree” that allows politicians to spend endlessly without concern for consequences. It’s an ideal framework for Trump and any debt-loving politician, as it seemingly justifies unlimited borrowing and spending.

Why Gold Is Your Ultimate Hedge

Despite recent volatility, gold is still up 24% year-to-date. Yet, many investors are nervous. This fear overlooks a critical reality: U.S. debt has been increasing nearly every month for the past 50 years. In October alone, the national debt rose by $600 billion — an annualized increase of $7 trillion. Under the MMT framework, debt is expected to rise even faster in the coming years.

Investors are unprepared for the economic reality that’s about to set in. Debt will continue to skyrocket, and when currencies start to lose value, gold will once again prove itself as the ultimate store of value — as it has for over 1,000 years.

The Sale Is On: Take Advantage of the Gold Dip

Markets naturally go through cycles of ups and downs, and smart investors take advantage of the dips. When products go on sale in a store, consumers rush to buy. Yet when stocks go on sale, people tend to panic and sell. Gold is currently at $2,600/oz, and many gold stocks are trading at a significant discount to their fair value. This represents a tremendous buying opportunity.

A debt crisis is inevitable, and it’s coming sooner than most people think. As debt continues to rise unchecked, gold prices will climb — possibly much higher than today’s levels. Some experts believe that to restore faith in government currencies, gold may need to reach as high as $25,000/oz.

The Golden Portfolio: Your Ultimate Gold Investment

I created the Golden Portfolio to be the ultimate gold investment, and its performance so far in 2024 speaks for itself. Now is the perfect time to get on board. We are at the beginning of a gold and gold stock mania. There’s a long way to go, and the smart money is already positioning itself.

Don’t wait for the next crisis to unfold. Take advantage of the current dip, secure your position, and watch as gold continues its upward march. The economic storm is brewing, and gold will be your safe harbor.