Editor’s Note:

This morning, I just released a brand new investment brief on my favorite gold stock to own right now. With a minor correction in gold prices, the discount to buy this company is even bigger than it was a few days ago when I was putting the finishing touches on my analysis.

I believe my #1 gold stock to own right now will be up 5X higher sometime in the next few months – for reasons I cover in my investment brief.

Click here to see my full write-up on my favorite gold stock right now.

For the past month or so, I’ve been telling you a correction is not just likely, but also that it’s a normal part of every bull market.

In part, my goal was to prepare you for this moment emotionally and psychologically. Bull markets, as they say, climb a wall of worry. The gold market is no different.

We’ve had the privilege of seeing gold (and silver) prices rise with almost no abatement for the past 3 months. It’s easy to get used to nothing but higher prices, but it’s not a normal phenomenon. What usually happens is that people replace their euphoria with fear when the correction comes, and they sell at the worst possible time.

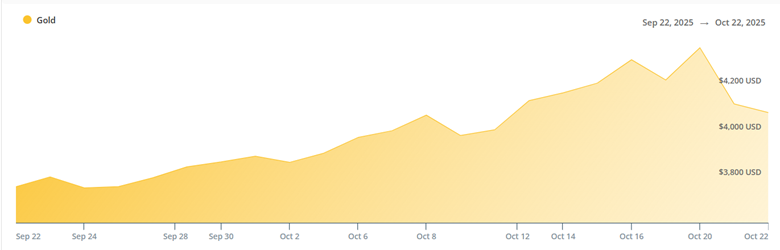

Some context: gold is still higher than it was two weeks ago…

It’s still within 10% of all time highs too.

The majority of gold companies I cover tend to use $3,000 gold or maybe $3,500 gold when they build their projections for the coming year.

That means we have a margin of safety within the valuations…

But right now, gold stocks are getting hit hard by the correction in gold too:

GDX is down 10% from just a few days ago.

I don’t recommend owning GDX, but it’s a decent proxy for seeing how gold price corrections can impact gold majors.

“Buy My Favorite Gold Stock Now…

See 400% Gains by May of 2026”

The biggest gains in gold investing are never made in the metal. And one gold analyst named Garrett Goggin has proven time and time again that he has the ability to spot gold stocks before they go on massive runs…

Garrett currently has open gains of 142%… 193%…193% and 853%…

Today, Garrett is convinced one gold stock above all others is primed for a historic run.

He just released a free investment brief detailing why this company is so compelling right now.

Click here to see Garrett’s #1 Gold Stock Now

The question: what to do now?

Most people will do nothing. They’ll wait for some big obvious signal to tell them to load up on gold stocks. I’m here to tell you that signal will never come. It will never be that obvious.

But when you see a correction in gold, and a corresponding dip in gold stocks, you should be looking to buy.

Just like we didn’t know when this correction was coming, we don’t know when it will end.

It could be a week. It could be a month. Maybe longer. Maybe it’s already over…

But when gold stocks go on sale 10% in the middle of a bull market in gold, you should be looking to add to your favorite positions – or to build a position in companies on your radar.

If you doubt this claim, consider what is more likely: that the gold bull market is taking a breather, or that it’s over – and for the first time ever a gold bull market lasted for two years instead of ten…

Even though the Federal Reserve is cutting interest rates…

Even though the US Government is shut down and Congress is incompetent…

Even though debts and deficits are slated to rise for years to come, weakening the dollar further…

Even though central banks are buying record amounts of gold…

Would a bull market in gold end now with a fizzle?

I’m telling you: absolutely not.

We’re going to look back at October 22, 2025 not as the end, but as a mild correction when we should have bought more high quality gold stocks at a discount.

Mark the calendar. Look back at it a month, 6 months or a year from now. I think you’ll either be kicking yourself that you didn’t buy more, or you’ll be pleased with your decision that you did buy more.

Normally, I don’t make overt sales pitches for my services in this free letter. My goal is to keep you informed and to give you the context I would want if I was in your shoes.

I really do not want to be “salesy” – because I don’t like getting aggressively marketed to either.

So, I’ll just end today’s issue with a reminder: earlier today I released the full details of my favorite gold stock to own right now.

With the correction in gold’s price, the opportunity is even better to own this company now than a week or so ago. I think if you put money into this stock now, you’ll be very pleased.

And I’ve purposely added this stock to my lowest-priced service – to make it as inexpensive as possible to own it.

All you have to do: click here to read my research into this opportunity.

Thanks,

Garrett Goggin, CFA, CMT

Lead Analyst and Founder, Golden Portfolio