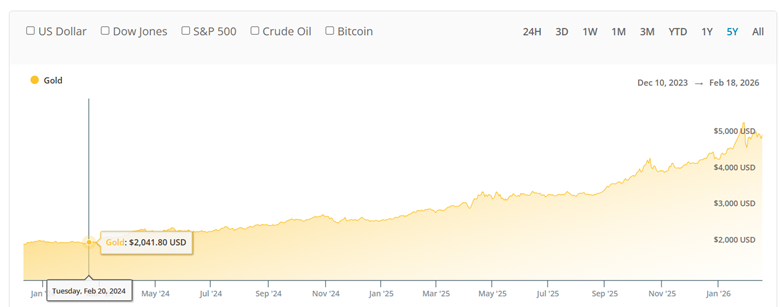

It’s easy to forget the conditions that brought us from $2,000/oz gold to $5,000 gold in just 24 months.

These conditions weren’t unique to two years ago.

We’ve seen gold outperform almost every asset in existence for the past 20 years – yes, beating out stocks too.

The conditions?

A structurally doomed Federal budget that:

1) is growing every year and

2) is now so massive there’s no possible way to tax our way to paying for it.

The very sharp analyst Lyn Alden referred to this impending, ongoing problem back in 2024 with this one liner:

“There’s no stopping this train.”

Consider: between Trump’s inauguration last year in January through November, his administration cut 270,000 employees – a 9% reduction.

The libertarian think-tank, the Cato Institute says it’s the largest peace-time Federal workforce reduction ever.

But at the same time, Federal spending surged to $7 trillion. That 9% reduction came out of a relatively small part of the Federal budget pie – a $336 billion slice, which itself is just 5% of annual spending.

Cutting 9% of 5% of spending is like trying to buy family groceries from the “take a penny-leave a penny” container.

Meanwhile, interest expense hit $1.2 trillion last year, which was higher than defense or Medicare spending.

The US Federal budget is being eaten alive by interest expense and un-cuttable entitlement spending.

Every step FedGov might take to reduce interest expense simply fuels inflation.

Every step they take to cut discretionary spending risks reducing the efficacy of things like tax collection (boo hoo) or Federal law enforcement.

The DOGE chapter in US history proved that far from stopping the train, they can’t even slow it down.

It’s accelerating.

The conditions that gave us $5k gold have not improved. Even the rosiest estimates from the Congressional Budget Office predict these conditions will worsen for at least another decade.

We are very likely to see continued corrections in the gold price – but the long-term trajectory will follow this train.

The last time we had a generational bull market in gold was in the 1970s – and as I wrote recently to my paid subscribers, that bull ended with an “event.”

The event was a massive new interest rate policy – with Paul Volcker setting rates so absurdly high that it became a no-brainer for everyone to ditch gold in favor of Treasurys.

With record high interest rate expense, no such Volcker policy is coming. Every 1% increase in interest rates means a massive $380 billion in eventual interest payments…

This bull market will end with a monetary revolution not seen for nearly a century.

Don’t stand in front of this train. Ride in its wake until the end.

Best,

Garrett Goggin, CFA, CMT

Lead Analyst and Founder, Golden Portfolio