Editor’s Note: This Wednesday, October 22, I’m releasing the full details of my #1 gold stock I think you should own today.

All you need to do: pay attention to your inbox on Wednesday morning. I will send you a full investment brief about why this company is my favorite, including details on how you can own it as well as a way to see a recent interview I had with this company’s chairman.

I asked him about his plans to quadruple production in the coming years…

How he thinks the company will be re-valued once they start producing in early 2026…

And how he compares this project with his prior projects – including details on the simplicity of this project compared to others he’s completed in the past…

You can not get this level of expertise and deep research unless you also have the Executive Chairman on speed dial.

Don’t miss it…

Gold is a major asset. That means that trends play out over years, not months. The last two major bull markets in gold lasted 10 years (between 2001-2011) and 9 years (1971-1980).

And in every bull market, corrections are the norm.

These corrections can and usually do crush the margins of otherwise booming mining stocks. In the 1970s during the biggest gold corrections, we saw 50%+ declines across gold mining indices. Ugly for sure, but very normal. In every case, these indices all soared after the dip and in the case of the 1970s, ended up being the best performing asset class of the decade by no small margin.

Though we’re nowhere near serious correction territory, any minor dip in gold these days seems to send gold investors panicking.

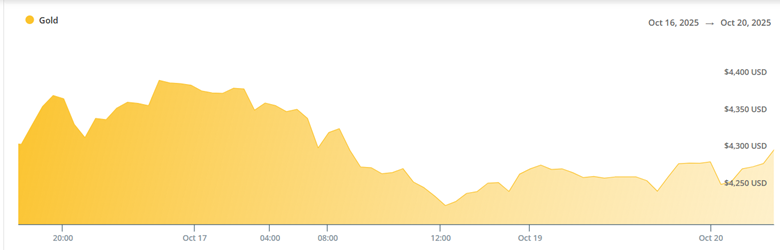

Last Thursday, gold nearly kissed $4,400/oz, and then it fell to $4,225/oz by Friday afternoon. That’s a 4% move down…

That decline from all-time dollar denominated highs back to prices seen only a day previous was enough to drop GDX by 10% in just one day.

Remember: until Wednesday of last week, gold had never been above $4,200/oz…

A month ago gold was at $3,700.

These kinds of big upswings tend to drag gold mining stocks upward – and to aggressively punish them on any minor decline.

The only real exception is in gold royalty stocks.

These companies are much more slow moving than most gold miners.

In the world of gold investing gold royalty streamers are the tortoise. Miners are the hare. And just like in the fable, the tortoise wins, at least eventually.

At almost any given time in a gold bull market, royalty streamers seem to be losing to miners. And look, there’s no doubt in my mind that we will continue to see some fantastic returns on my favorite gold miners.

Already this year we’re up well over 100% average across the ~30 gold miners I cover. Gold is up 60%+ ytd, but we’re seeing my top performing gold miners up 297%, 210%, 258%, 291% and 423%.

It’s a great time to be in these companies and I expect to see more of my gold miners start to hit their stride in the coming months…

But over the next 5+ years… 10 years… 20 years?

The royalty streamers will eventually win the race. Right now, if you look at my royalty service (Golden Portfolio) it’s still up over 100% on average, but the top gains are a bit muted compared to my gold miners, with my best performing royalty company up 206% on the year. There are a few others in that same territory, up 160%, 165%, 183%, etc.

When gold soars, these companies do well – just not immediately and directly well as the small gold miners I cover. That’s because the small gold miners I cover have a very direct relationship with gold’s price.

Most only have one or two gold projects and it’s simple to see how a $100/oz gold move either boosts or diminishes the underlying value of the whole company.

Royalty streamers on the other hand typically have dozens of royalties on projects across the board, from exploration to development to production. It’s not so simple to see how an intraday move in gold’s price should impact the share price of royalty streamers.

And when gold dips, these companies also seem to not see the kind of immediate downside shellacking that the miners do.

That’s also because miners' costs stay high even if gold price dips… which means their margins get crushed.

But gold royalty firms have fixed, and extremely low overhead. Most of the gold royalty streamers I cover have high margins even at $3,000/gold. Many are still printing money at $2,000/oz.

These miners have been negotiating different deals with different miners for decades in some cases.

Some of them negotiated their lifetime royalty streaming deals when gold was $1,000/oz. A move from $4,400 to $4,200/oz means the $1,000/oz royalty owner is not something to lose much sleep over.

Best,

Garrett Goggin, CFA, CMT

Chief Analyst & Founder, Golden Portfolio