“The truest sign of intelligence is the ability to entertain two contradictory ideas simultaneously.” – F. Scott Fitzgerald

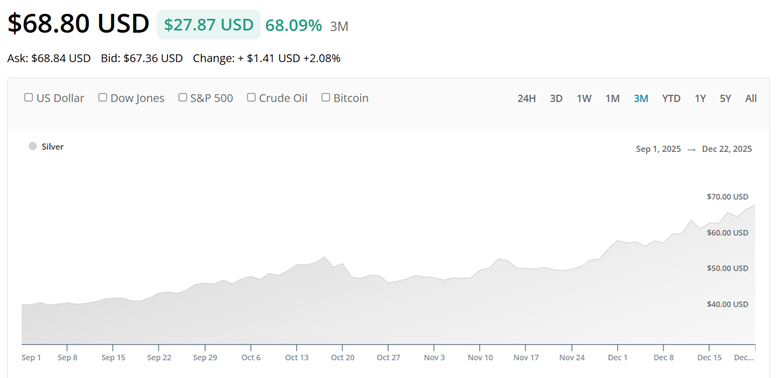

Silver is going bonkers – after blowing past its previous all-time dollar denominated high in October, it took a one-month breather before resuming what can only be described as a historic bull run.

The metal is up 68% in just the past 3 months. An ounce of silver now buys more than a barrel of oil for the first time since 1980.

When silver behaves like a bottle rocket, you need to take precautions – because just as surely as it soars, silver is notorious for dropping like a rock.

You might be asking yourself: “we know that every major central bank is working hard to devalue their currencies – so isn’t it likely that silver will continue higher?”

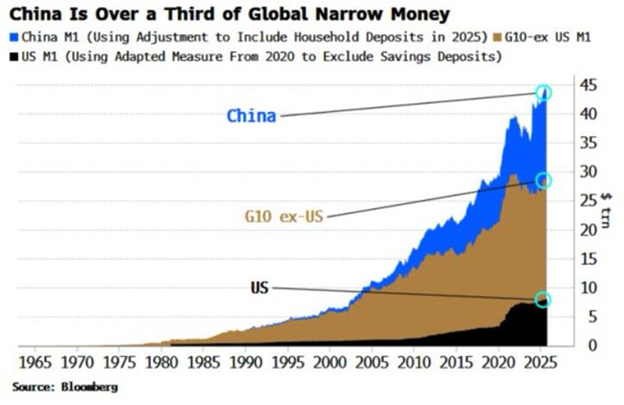

It’s true. I focus mostly on the US dollar with regard to gold and silver prices, but every central bank is playing the same kind of devaluation games.

Every bank is printing like crazy AND most of them are buying gold like crazy. Over the long term – yes, I believe silver is likely to move much higher.

But if you own silver stocks, you need to be very careful when silver pops like this. Earlier today, I issued a sell alert for two of my silver positions in the Golden Portfolio 10X service.

Why?

The big reason: they haven’t been performing well even during this insane run-up in silver’s price. I also believe these two companies have made unwise financial moves over the past few months.

A rising price covers up sins of poor management, but if/when the price corrects? These companies are going to take a beating.

You can be 100% correct that silver prices are going to move higher over the long term… but being correct doesn’t help you when a price correction reveals that the stocks you own were not being well managed.

So while it may seem like an inconsistency to be long term bullish on the metal while paring back silver stocks, it’s actually not. For one: I think if you own physical silver (or gold) then you probably understand the role of monetary metal in your possession as a form of savings that can not be inflated away by central bankers.

That’s a totally different thesis from the rationale behind owning silver miners. If you are buying silver miners, it’s because you have an expectation to earn capital gains above and beyond moves in the price of the metal. If the stock can’t perform even during a historic bull run, you need to be a faithful steward to your thesis, and cut the company loose.

Always be examining your investments to make sure the underlying thesis is intact. If the story changes, you need to be flexible enough to walk away. Opportunities are made up much easier than losses.

That’s true for gold stocks too, of course. But silver is much more volatile and silver stocks multiply that volatility with their own uncertainty.

Silver mines are expensive to build too… with high silver prices, some very marginal mines start to look economically viable – but with any kind of correction, they can go from meagerly profitable to a bonfire for capital.

If you own silver stocks, and they’re not doing well now, it’s a warning sign. Don’t ignore it.

On the other hand, I’m still extremely bullish on a very exciting junior gold mining company that’s literally days away from first production.

It’s my #1 conviction gold miner to buy today – and you can still own it before the rest of the market catches on.

Click here for the full details.

Best,

Garrett Goggin, CFA, CMTLead Analyst and Founder, Golden Portfolio