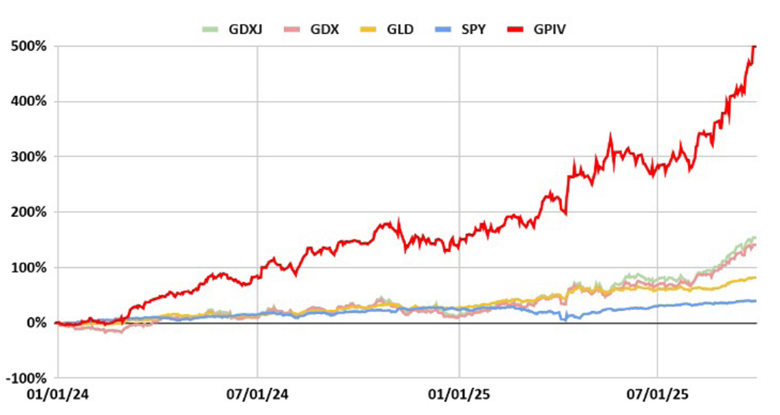

I own gold. But my main focus is on gold stocks. And the main story for gold stocks right now (even though they’ve done quite well) is that the best ones are still undervalued based on ~$3,000 gold, let alone $4,200 gold.

Gold can fall quite a bit from here without damaging my fair value estimations, or the price I believe you can feel comfortable paying to own these companies.

After years of underperforming gold, the tide has certainly begun to shift – but I’m confident this trend will continue – even if we see a short term correction.

And a correction might not look like what you expect. If you’re waiting for gold to fall 30%, it just might not happen.

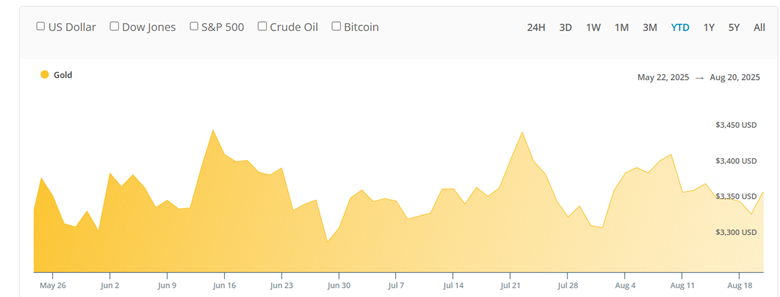

If you recall, for most of this past summer we saw gold go nowhere. From the end of May through the middle of August, gold mostly traded in a narrow range between $3,300 and $3,450.

That’s not a “correction” per se, but it was an extended breather. We might only see small downward moves or flat pricing for a few months at a time, instead of severe price corrections.

There’s no way to know, but we can look back at previous bull markets for some clues.

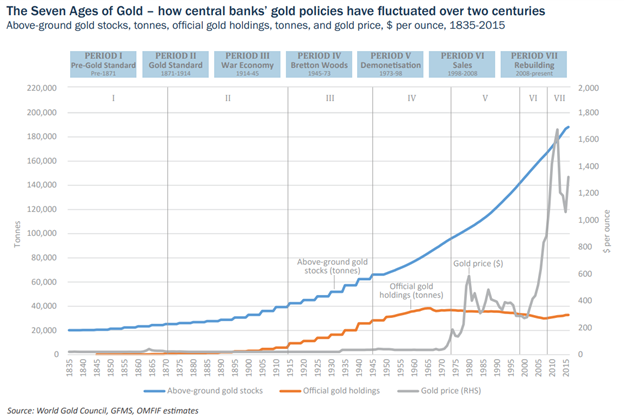

The issue is that the biggest previous bull market during the 1970s occurred under a very different market scenario.

For one, consider that many central banks were net sellers during the 1970s, not net buyers like they are today.

You can see in this chart that official gold holdings fell, represented by the orange line sloping downward starting in the mid-late 1960s and continuing through the 2000s.

That was a period of demonetization of gold – as world banks pared their gold holdings.

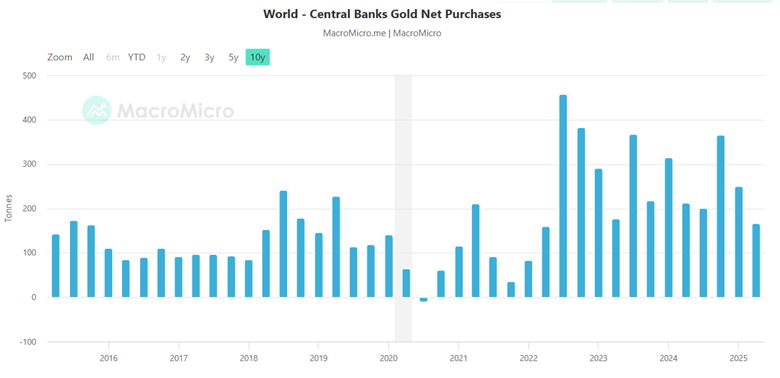

But since ~2015, that trend has reversed:

We’ve seen central bank net purchases well over 100 tonnes/year for most years since 2015.

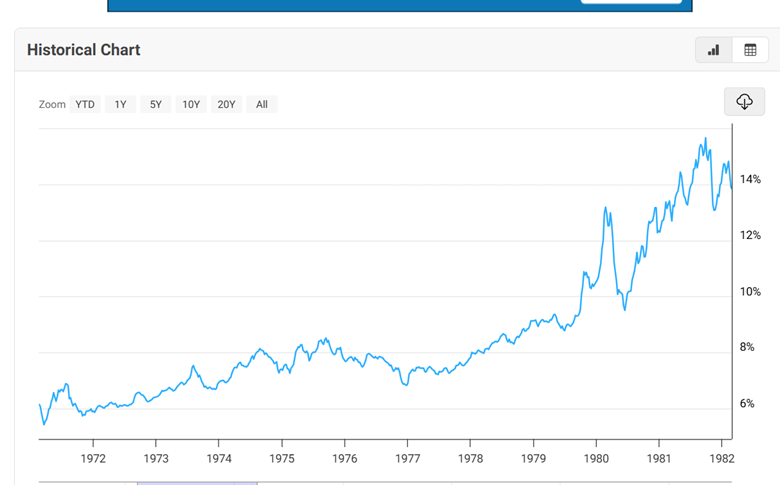

Consider that gold prices also rose in the 1970s while the Federal Reserve was actively raising rates. The chart below shows 10 Year Treasury yields throughout the gold bull market.

Today, the Fed is doing the opposite. They just cut rates back in September, and they’re talking about at least one more rate cut in 2025.

The Fed in the 1970s was raising rates to stop runaway inflation. The Fed today is cutting rates to buoy asset prices and devalue the dollar.

You have to ask yourself: besides the fear that gold has risen too far, too fast: what market factors are likely to kick in to slow down its rise?

I’m not saying we won’t see a correction. That’s always possible, and as we saw in the 1970s, it’s a perfectly normal part of a massive bull run.

I am saying: the real number to pay attention to is the valuation of the gold stocks. And what I’ve found is that most of them are still drastically undervalued even after the big run we’ve seen this year.

Don’t miss out.

Best,

Garrett Goggin, CFA, CMT

Chief Analyst & Founder, Golden Portfolio

P.S. I have a big announcement coming up next Wednesday, October 22nd. I’ve been going through all of my stock research to find the single best opportunity.

I’m putting the finishing touches on an investment brief that I will release next week. In short, I will reveal the #1 best stock I think you should own for this bull market in gold.

I believe this company could jump 400% between now and the end of Q1 2026.

All you have to do: pay attention to your inbox next Wednesday for the full details.